DEADLINE TO FILE 2022 W-2/1099/MW508 FORMS FOR THE STATE OF MARYLAND

Form W-2

Form W-2 is due on

January 31, 2023.

Form 1099

Form 1099 is due on

January 31, 2023.

Form MW508

Form MW508 is due on

January 31, 2023.

Form 1099/W2 Tax Filings of Maryland State

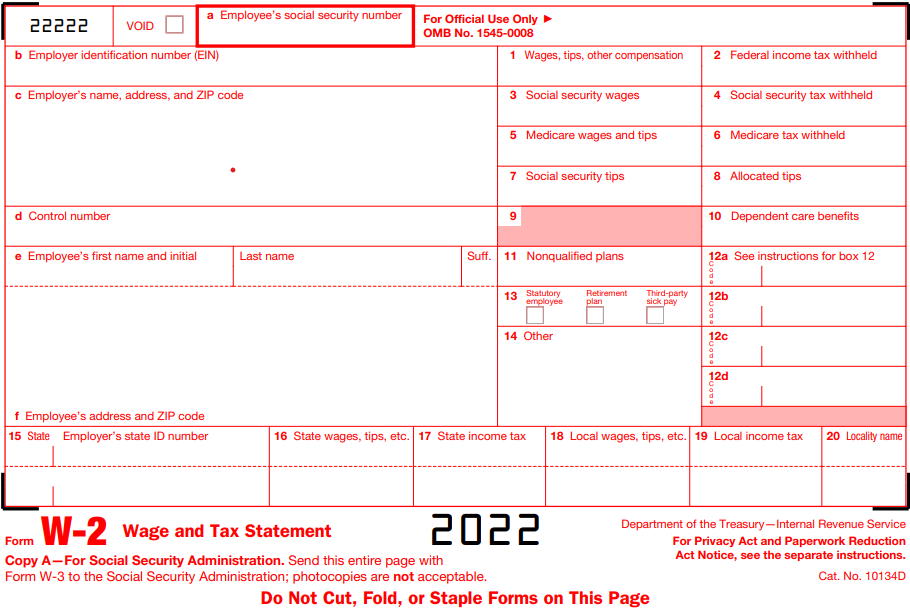

Form W-2

The Maryland state mandates the filing of the Form W-2 only if there is a State tax withholding. Form W2 is used by employers to report the employee’s wages and taxes withheld such as social security, medicare, etc.

Also, The State of Maryland mandates the filing of Form MW508 along with your W2 Forms.

What are the special fields required when filing a Form W-2 with Maryland?

When e-filing Form W-2 for Maryland, the state requires

- Maryland State Pick-up Amount

- Employee Withholding Allowance (Number of exemptions claimed on Form W-4 Employee’s Withholding Allowance Certificate) as their special field.

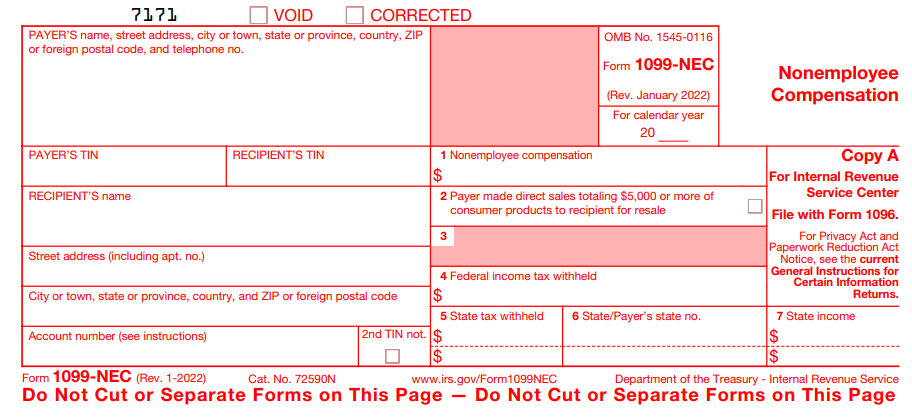

Form 1099

The Maryland state mandates filing 1099 Forms even if there is no state tax withholding. The State of Maryland participates in the CF/SF program. And thus, your 1099 forms will be forwarded by the IRS automatically to the State.

Form 1099 is used by individuals/businesses for the payments made to independent contractors, real estate proceeds, fishing boats proceeds, interest income, dividends & distribution, and even more.

Also, the State of Maryland mandates the filing of State Reconciliation Form MW508 along with your 1099 forms.

What types of 1099 forms does Maryland state require?

Maryland state requires the following 1099 forms to file, even if there is no state tax withholding.

| Form 1099-NEC | Form 1099-MISC |

| Form 1099-R | Form 1099-G |

Form MW508: Employer Withholding Annual Reconciliation

Employers must reconcile their W2/1099 statements by completing Form MW508, Employer’s Annual Withholding Reconciliation Return, and submit it along with the W-2/1099 forms only if filing with paper. Electronic filers do not need to file Form MW508 as the form gets generated automatically when filing Form W2s/1099s with the State of Maryland.

Information Requirements to file W-2 & 1099 Forms

To complete W-2/1099 Maryland state filings, you need to provide the following information:

- Employer/Payer Information: Name, EIN/SSN, and Address

- Employee/Recipient Information: Name, EIN/SSN, and Address

- Federal Details: Wages/1099-payments and Federal Tax Withholdings

- State Details: Maryland State Income, and State Tax Withholdings

Marylandtaxfilings.info - An easy to Use Tax Filing Solution

MarylandTaxFilings.info offers a direct, user-friendly e-filing process that will guide you with step by step instruction to e-file W2 and 1099 Forms. You can continue filing from where you left with our Cloud-based software. Our US Based Customer Support helps you throughout the filing process.

Why Cloud-based MarylandTaxFilings.info is Your Best 1099/W-2 Filing Solution?

With marylandtaxfilings.info, you can transmit the returns directly to the IRS. With our exclusive e-filing features, you can use our bulk upload template to import all of your employees/recipients information, instead of manually entering one-by-one. You can use our postal mailing feature to get the hard copies of your returns mailed to each of your recipients on behalf of you. You can also access the already filed returns anywhere at any time with our print center feature.

You can also file your employment tax forms 940, 941, 944, and 1095 Forms along with your W-2/1099 returns.

| Where to mail Maryland state filing Form 1099/W2? | |

|---|---|

| Mail Form W-2 along with the Form MW508, | Mail Form 1099 along with the Form MW508, |

|

Revenue Administration Division, ATTN: Returns Processing, Room 206, 110 Carroll Street, Annapolis, MD 21411-0001. |

Revenue Administration Division, ATTN: Returns Processing, Room 206, 110 Carroll Street, Annapolis, MD 21411-0001. |

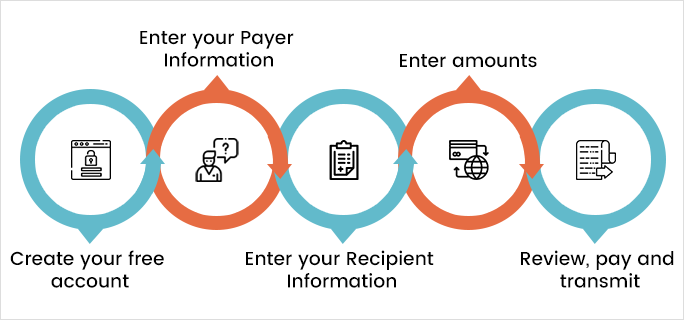

How to E-file W-2/1099 with the State of Maryland

Quickly follow the below steps to file W-2/1099 forms for Maryland

- Step 1: Create a free account. Choose W-2s/1099s as per requirement.

- Step 2: Enter your Employer/Payer information such as the Name, EIN/SSN, and Address.

- Step 3: Enter the Employee/Recipient information, including Name, EIN/SSN, and Address.

- Step 4: Enter Federal/State information for W-2/1099-Payments, and Taxes Withheld.

- Step 5: Review, pay, and transmit the forms.

Maryland Paystub Generator

Whether you're in Louisville, Lexington, Bowling Green or anywhere in Kentucky state, our Maryland paystub generator will calculate the taxes accurately. There is no need for desktop software. Save time and money with the paystub generator that creates pay stubs to include all company, employee, income and deduction information. Just follow the simple steps and email your paycheck stub immediately, ready for you to download and use right away.

Get Your First Paystub for Free

Get started to File your Form 1099/W2 with our cloud based software

Contact US

Simply contact our US-based, support team for any assistance or queries. We support over the phone(704.684.4751), live chat, and 24/7 email - support@taxbandits.com.

We are here to support you directly from SPAN Enterprises LLC, 2685 Celanese Road, Suite 100, Rock Hill, SC 29732. .